What You Need to Know About Insurance Companies in Truck Accident Claims

Legally Reviewed and Edited by: Terry Cochran

Were you or a loved one involved in a truck accident? Then you need to understand how insurance companies and truck accidents work.

Truck accident claims are often complicated, partly because they may involve multiple liable parties and complex federal and state laws.

When multiple parties are liable for a truck accident, you must deal with multiple insurance providers to negotiate your claim. This alone can be overwhelming, especially when you’re already dealing with the physical and psychological injuries from your accident.

But you can work with a truck accident attorney to help you navigate the legal aspects of your truck accident claim while you focus on physical recovery.

Types of Insurance Coverage Involved in Truck Accidents

If you are injured in a truck accident, you may have to file your claim against more than one insurance provider.

Most commercial vehicles carry different types of insurance coverage to address different issues, including accident liability and property damage. The common types are:

- Commercial liability insurance is the primary coverage that handles damages when the truck driver or company is at fault. Trucking companies must carry minimum coverage of $750,000 for general freight under federal laws, but many carry coverage of $1 million or more.

- Excess or umbrella insurance provides additional coverage above the primary policy limits. This additional protection can provide an extra $1-5 million in coverage for more severe accidents.

- Cargo insurance covers damage to the freight being transported, while physical damage insurance handles repairs to the truck itself.

- Uninsured/underinsured motorist coverage may come into play if the at-fault party lacks sufficient insurance coverage.

How Insurance Companies Determine Fault in Truck Accident Claims

Insurance companies are actively involved in investigating truck accidents. But their interest is not in offering you fair compensation. Rather, insurance companies aim to reduce their financial burden; therefore will look for evidence that you were at fault in any way for the accident.

Their adjusters will review the police reports and any photographs of the accident scene to determine the cause of the accident. They may even visit the scene for their own analysis.

Once they have a picture of what happened, they may call you about the accident. During the call, they may request, among other things:

- That you provide a medical release form (it authorizes the insurance company to access your medical records)

- Your side of the story about what might have happened during the accident. If you are not careful, you may find yourself admitting fault for the accident.

- That you accept the first settlement offer they make

They will also speak with the trucking company and driver to gather additional information, including the driver’s logs, maintenance records, and records of vehicle damage after the accident.

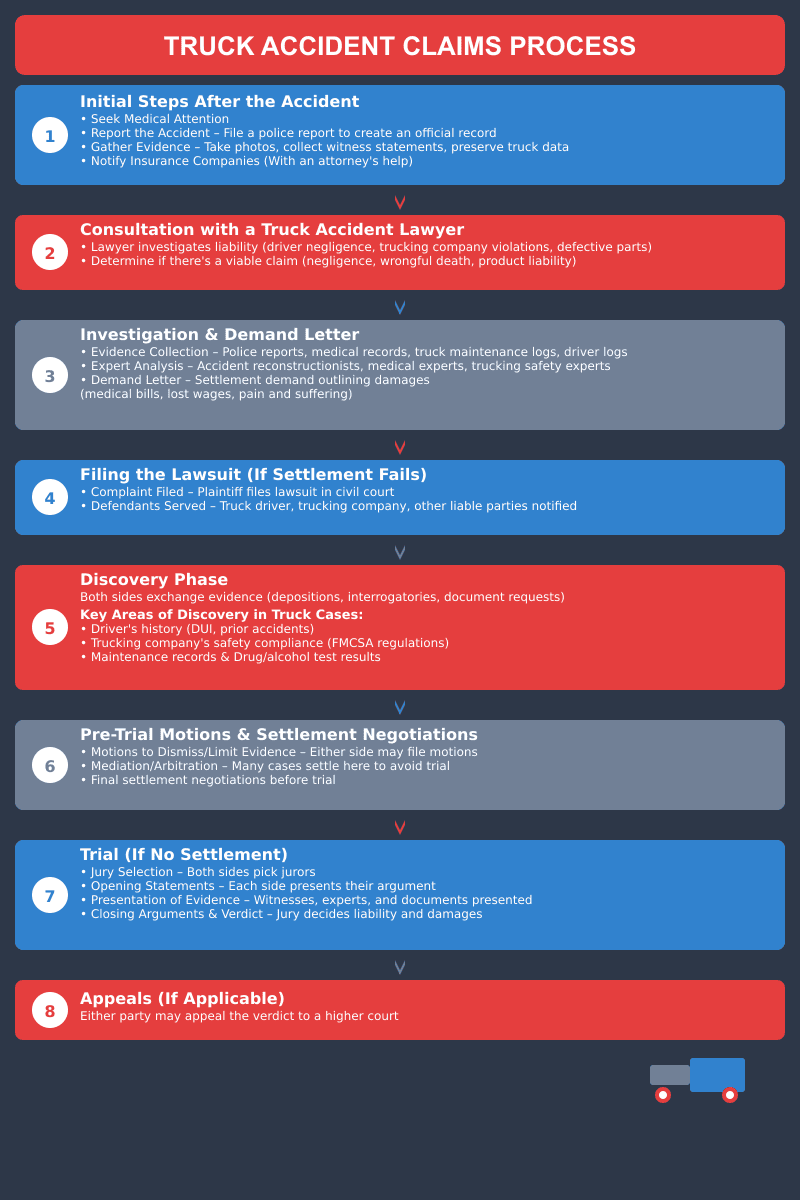

The Truck Accident Insurance Claims Process

Filing a truck accident insurance claim is inevitable when you’re involved in a truck accident. It is the first step that sets you on the path to recovering compensation for your injuries.

Since truck accidents often involve multiple liable parties, you may have to send claim forms to several insurance companies, including your own. In this case, working with a reliable truck accident attorney can make the process easier for you.

They can help you identify each party’s role in the accident, therefore, their responsibility in compensating you for your injuries. An attorney will also help you calculate your damages, so you are clear on what you are asking for.

Once the claim forms are sent to insurance companies, it kick-starts a series of offers, counteroffers, and negotiations as both parties seek to settle the claim. Most truck accident claims settle outside court, but a few go to trial.

The Role of Insurance Adjusters in Truck Accident Cases

Insurance adjusters work with insurance companies to reduce these companies’ financial exposure. Their work is to investigate truck accident settlement claims and minimize the company’s payout as much as possible.

Often, they will dangle truck accident settlements that sound good, especially since they contact you soon after the accident when you haven’t understood the full extent of your injuries. As part of their investigation, they will request a recorded statement and your medical records.

How to Maximize Your Insurance Settlement After a Truck Accident

You can maximize your truck accident settlement in several ways:

- Get medical treatment immediately after the accident, even when you feel fine. Ensure you tell the doctor that you’ve been in an accident so they can examine you for internal injuries that often go unnoticed in a truck accident. Prompt medical treatment establishes a link between the truck accident and your injuries.

- Document photos of the scene, vehicle damage, your injuries, medical records, employment records showing lost wages, and receipts for accident-related expenses. Such comprehensive documentation strengthens your truck accident claim.

- Follow your treatment plan religiously. If your doctor says you need physical therapy, go to physical therapy. Skipping treatments gives insurance companies ammunition to argue that your injuries weren’t that serious.

- Avoid mistakes such as discussing your accident on social media or admitting fault at the accident scene, as the defendant could use this information against you.

Common Truck Accident Insurance Pitfalls and How to Avoid Them

Here are the common pitfalls that can reduce your truck accident settlements:

- Giving insurance companies access to your medical records. Hire an attorney before you sign a medical release form. Truck accident lawyers ensure that you do not give insurance companies access to medical records that they could use against you to diminish your claim.

- Settling quickly is another common mistake when dealing with insurance. Insurance companies want you to settle as fast as possible for as little as possible to minimize how much they pay out while ignoring the full financial impact of the accident.

- Giving a recorded statement without an attorney present is another common mistake when dealing with insurance after truck accidents. Insurance companies want your sworn statement, which they will use against you to reduce the settlement. An attorney can help you navigate the vague questions and leading statements that could affect your claim.

- Settling before understanding the long-term impact of your injuries can leave you dealing with mounting medical bills with no legal recourse. You can avoid this mistake by ensuring you achieve maximum medical recovery before settling.

When Should You Consult an Attorney About Your Truck Accident Claim?

You should contact a lawyer immediately after a truck accident to give them time to collect evidence and witness statements. Here are a few times when you should hire truck accident attorneys:

- You were injured in a truck accident (regardless of fault)

- You suffered a serious injury that needs ongoing medical treatment or could cause permanent disability.

- There are disputes over truck accident liability

- The insurance company has denied or won’t settle your claim

Navigating Truck Accident Insurance Claims

If you or someone you love has had their life changed by a truck accident, get the legal representation you need. Speak with our compassionate, knowledgeable truck accident lawyers at Cochran, Kroll, & Associates, P.C.. We can review your case, guide you through the claims process, and draft an impactful victim impact statement for your truck accident case. Contact us today for a free, no-obligation consultation.

Our contingency fee basis means we only get paid if we win your case, so there is no financial risk to you to get started. Call our law firm today at 1-866-642-4529 and schedule your no-obligation, free case evaluation.

Disclaimer : The information provided is general and not for legal advice. The blogs are not intended to provide legal counsel and no attorney-client relationship is created nor intended.